Find & FinanceProperty

Learn about interest rate cycles and how to manage interest rate risk

A lot of seasoned property investors were caught out by steep and sustained interest rises in recent years. Rising interest rates can have a significant impact on cashflow.

Understanding what drives interest rate changes and the economy in general can insulate property investors from the adverse impacts of rising interest rates.

This article provides insights into understanding economic forces and interest rate cycles.

Key points

Fluctuating interest rates are not readily understood, nor easily predicted.

Understanding interest rates and what drives them can improve your bottom line.

Learn to recognise inflationary and deflationary pressures and their impacts.

Go deeper than the headlines and do your own research to be ahead of the game.

Don’t be afraid to lock in low interest rates when appropriate to do so.

Interest rates and money supply

Interest is the price you pay to borrow money.

If you think of borrowed money like a commodity, it’s price (the interest rate) is largely governed by supply and demand pressures. In this way, interest (the price of borrowed money) is like any other market and is subject to market forces.

Economic forces that increase or decrease the supply and demand for borrowed money include:-

Deflationary pressures like:-

falling asset values

rising unemployment

falling consumer confidence

higher taxes

reduced government spending.

Inflationary pressure like:-

rising asset values

a tightening labour market

rising consumer confidence

lower taxes

increased government spending.

Interest rates are reviewed regularly, and reserve banks meet about 8 times a year to review the cash rate, which is the benchmark wholesale interest rate at which banks lend money to each other.

Although interest rates are subject to regular review, there are risk managed options to lock-in interest rates for terms of between 1 to 10 years, although typically 3 to 5 years is a practical limit for most property mortgages. While generally, a premium is paid for taking out a mortgage at a fixed interest rate, there are rare opportunities when insightful investors can used fixed interest rates to significant advantage.

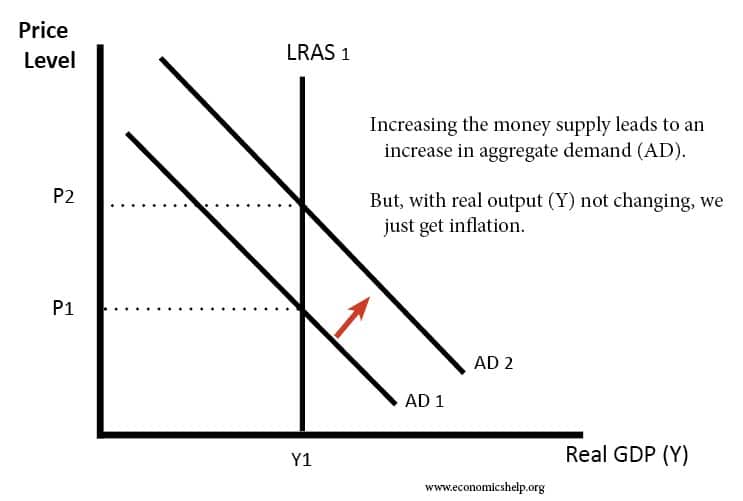

If the supply of money is too lose, it becomes inflationary

reserve banks respond by reducing the supply of money via increased interest rates

in an attempt to reduce demand for borrowed money, thereby dealling with inflation

Reserve banks and monetary policy

Modern economies work best when inflation is kept at a sustainable level, avoiding extreme periods of deflation (as experienced in the 1930s) and inflation (as experienced in the 1970s). Reserve banks and responsible governments work together to maintain inflation at around 2-3% to support economic growth. This is by no means an exact science, and significant economic impacts (like a pandemic, wars, and so on) can derail these efforts, and force reactive measures to be taken.

The tools that governments and reserve banks use to seek to manage an economy include:-

increasing or reducing government spending.

policies that support (or hamper) productivity.

tax policy raising or lowering interest rates (reserve bank).

quantitative easing (reserve bank).

Every situation is unique, but keeping an eye on developments in these areas can give property investors an insight into the forces that drive interest rate movements.

As an over-arching principle, increased income (in whatever form it takes) without increased productivity is inflationary.

Why did interest rates rise rapidly in 2022-23?

At the time of writing this article, many property owners are stretched with an interest bill that has doubled within twelve months.

The sudden and sustained rise in interest rates from mid-2022 onwards was not a surprise for those who understand and monitor macro-economic conditions and cycles.

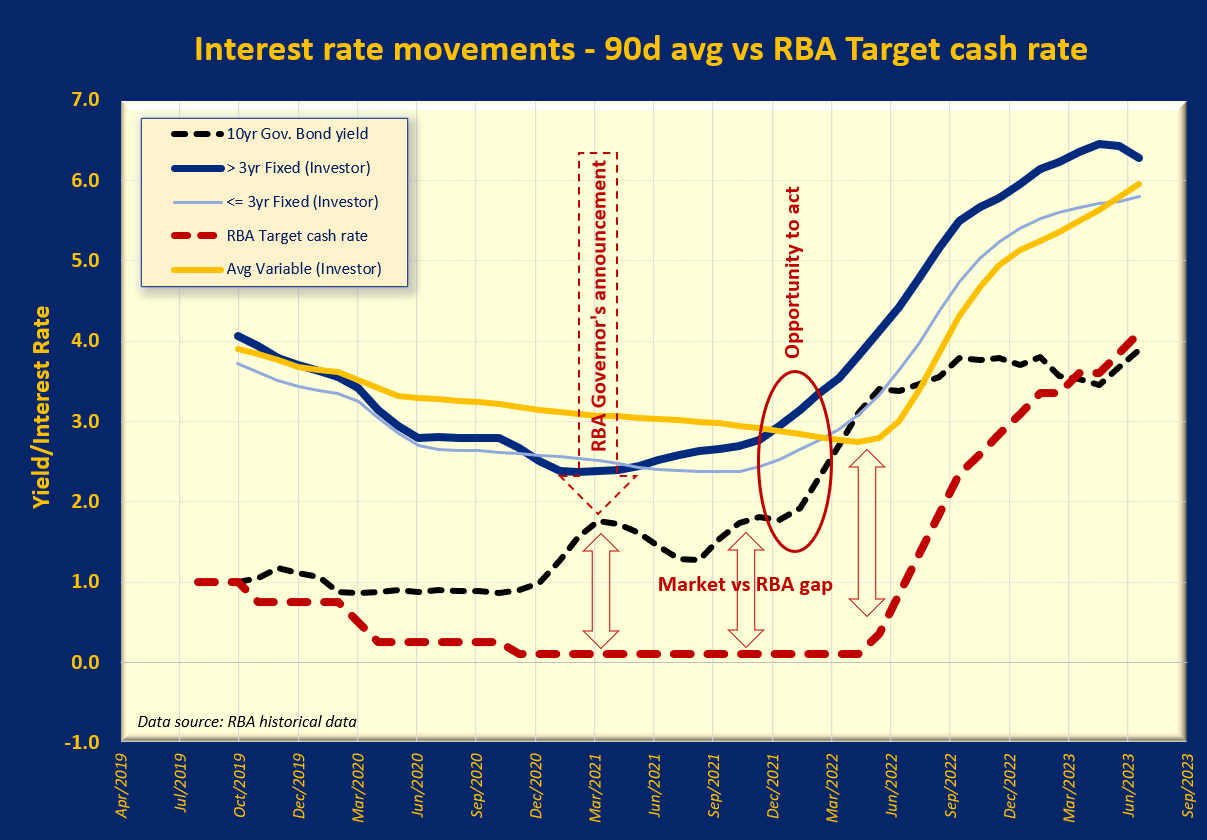

Irrespective of the Reserve Bank Governor’s statement in March 2021 that interest rates would remain low until “at least 2024”, by Feb 2022, it was obvious that the bond market was driving yields out of the Reserve Bank’s control, which ultimately resulted in increases to the target cash rate.

Insightful (and perhaps seasoned) observers understand that the economic and political rhetoric is often used to influence opinion and/or markets, to assist them to combat economic and/or political realities that are ultimately outside of their control.

The chain of events that led to sharp recent interest rate increases:-

world-wide COVID-19 pandemic.

significant potential for economic hardship and deflation to set in.

governments intervene with welfare payouts and economic stimulus.

reserve banks undertake quantitative easing (QA) programs.

the market devalues currencies, causing bond yields to rise.

economic disruptors (war, transition to green energy) feed inflation.

inflationary forces take hold of the global economy.

reserve banks raise interest rates to fight inflation by reducing money supply.

A missed opportunity?

There was ample opportunity for property owners to refinance and fix interest rates for up to 5 years at well below 4% in early 2022. Surprisingly, many respected property investment advisors were caught off guard, as were their clients, and are now paying 7% and higher interest rates for a prolonged period.

The period to fix interest rates for in a scenario like this depends on how long inflationary forces are expected to be at work. Research into historical records and previous inflationary periods prompted the author to adopt the maximum 5 years available at close to 3%.

Inflation vs deflation

Quantitative easing (QA), often referred to as “printing money” devalues the currency, similar to a ASX listed company issuing new shares out of thin air devalues all existing shares. We recognise this devaluation in currency as “inflation” – things cost more than they used to.

While out-of-control inflation is problematic, sustained moderate inflation actually helps an economy cope with debt. This is because the debts are devalued along with the currency, and as wages rise to keep pace with inflation, the overall debt burden is reduced. If inflation is higher than its target band, the Reserve Bank will raise the cash rate to reduce the amount of discretionary spending to counter inflation.

The fear of deflation often drives governments to spend more than they can afford to. By pumping more money into the economy to seek to stimulate it. Reserve banks also lower interest rates to encourage investment. However, if deflation takes hold, reducing asset values tend to drive investors out of the market.

From a property investment perspective, inflation is our friend because it increases the monetary value of our assets, and reduces our debt burden as long as our incomes increase with inflation. Our interests are aligned with the interests of government and the reserve bank. However, it is prudent to consider the sustainability of current government debt levels and/or the potential for a sustained deflationary environment. If you are concerned about this risk, you can mitigate it somewhat by operating at a lower LVR and choosing affordable properties that have wide appeal.

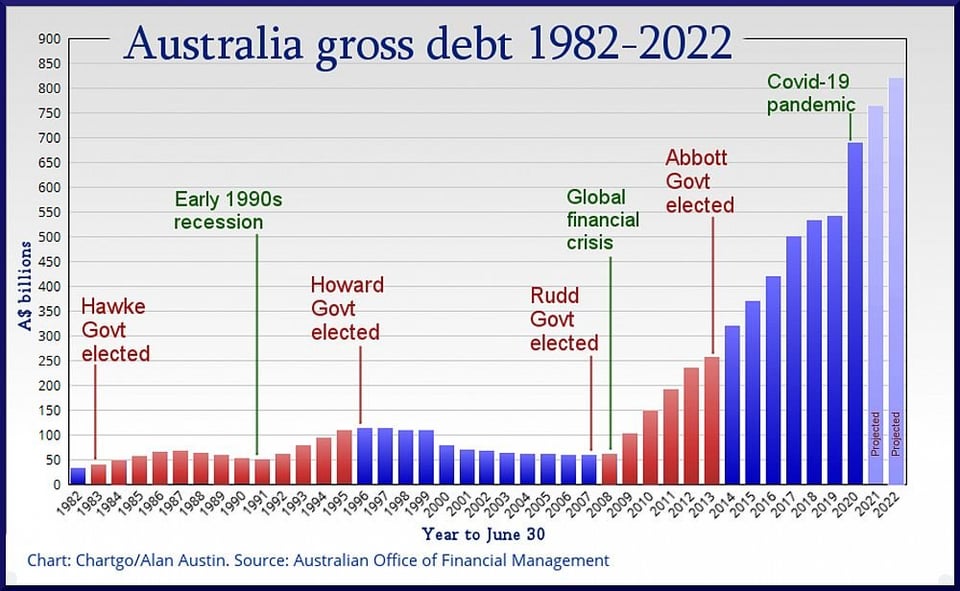

Government debt

In recent decades, government debts have increased significantly, and not been significantly paid down between the deflationary cycles, and therefore, continue to grow. It’s a slippery slope that creates the potential for a prolonged economic downturn. Japan experienced such a downturn between 1990 and 2010.

Modern economies have been dancing on this precipice for decades now, and some governments’ debts have been reaching close to unsustainable levels. In this scenario, deflation would effectively send governments broke; and that is likely to amplify the political turmoil we’ve experienced in recent times. Anything could happen.

Modern economies have been using government spending and QA effectively to ward off deflation, severe recessions and/or a depression like in the 1930s, and for the most part, without inflation getting out-of-control like in the 1970s. However, in recent years the combination of near zero cash rates and massive government (and private) debt make for an ever-narrowing range for sustainable financial settings. It’s hard to see a way out, and it appears that a day of reckoning and some kind of financial reset is due.

We have become so accustomed to such high debt levels, and skilled at avoiding crippling deflation that most economists seem to think that we can continue down this path indefinitely. Time will tell.

Macro-economic principles and the role interest rates play

I understand that my commentary on macro-economic principles will likely ruffle the feathers of some text-book economists. I would encourage everyone to keep an open mind and do your own research. After all, your exposure to interest rate risk is your business. Generally, banks, financial advisors and investment advisors won’t be able to help you with this one.

To assist, I have included some educational videos produced by eminent economists that I hope you find helpful in understanding macro-economic cycles and how interest rates work.

Ray Dalio is highly respected in the world of finance and economics, though his primary reputation is as an investor and hedge fund manager rather than a traditional economist. He is the founder of Bridgewater Associates, one of the largest and most successful hedge funds in the world.

Bridgewater is known for its innovative approaches to investment and risk management.

Conclusions

The deeper you dig into the management of the economy, the more you realise how complex it is, and how much policy is influenced by group think. Investors can benefit from taking a broader perspective and considering our current economic circumstances in historical context. Reserve banks set interest rates in accordance with their policy to keep things on an even keel. But sometimes the economic forces at play refuse to be manipulated.

Keep it simple

Investors can benefit from an understanding of the battle between deflationary and inflationary pressures and the tools used to combat them. When applying all of this to interest rate cycles, a few key principles are worth remembering:-

easy money (including quantitative easing) ultimately devalues a currency which is inflationary and puts upward pressure on interest rates

listen to statements from the Reserve Bank, but be mindful of the potential for rhetoric designed to influence a market that’s outside of its control

observe what the government bond market is doing

Government bond yields will tell you what the market is predicting (or in some cases driving) in terms of the value of the currency – whether inflation is devaluing the currency, or deflation is strengthening it. Inflation puts upward pressure on interest rates, and the opposite is true for deflation.

NEWSLETTER

Manage your risk - invest with confidence