Find & FinanceProperty

Investment property cashflow and how to manage it

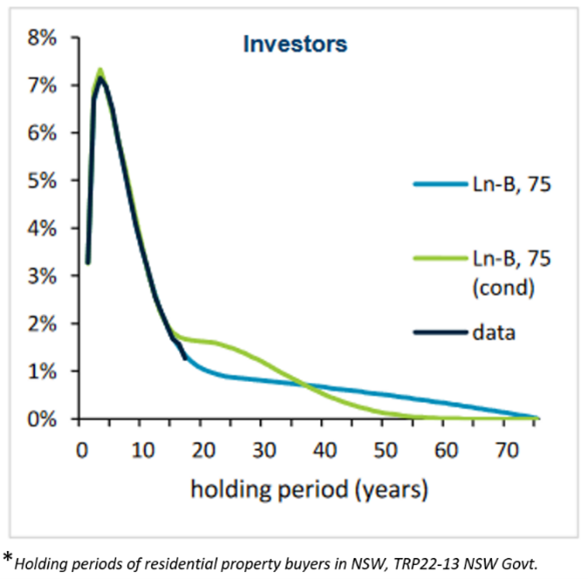

Less than 30% of property owners hold their properties for more than 20 years. Less than 20% of property owners hold their properties for more than 30 years. Conversely, about 30% of investment properties are held for only 5 years or less*.

Most property investors understand the benefits of long-term compound growth, with a recent survey of over 1,500 property investors finding that 90% of property buyers intend to hold their property for the long term.

That means that 20% of buyers are one way or another forced to sell earlier than they intended.

The purpose of this article is to inform potential investors about the risks associated with holding an investment property, and how to manage them to benefit from incredible compound growth.

Key points

Holding property for 20 years+ is recommended for property investment purposes

Most investment properties are held for less than 15 years.

Good cashflow planning and management is vital to holding property for the long term.

Calculating rental yield has it's place, but understanding cashflow is key to success.

Run a cashflow analysis to make sure you are fully aware of all holding costs before you buy.

Establish approriate insurance and adequate cash reserves to weather difficult times.

These figure demonstrate the wonderful benefits of compound growth

Cashflow killers

Investment property cashflow can be impacted by rent arrears, loss of tenancy, emergency repairs and other maintenance issues, interest rate rises, and loss of employment.

Political debate around removal of negative gearing and rent freezes, and legislative changes in some states confirm that government policy is perhaps an increasing risk to investment property cashflow.

As a property buyer, it's critical to understand and plan for these risks to realise the long term capital growth potential of your investment property.

Property buyers often use rental yield as an indicator of the viability of a property for their own financial situation.

How to calculate rental yield

Rental yield is simply the total amount of rental income divided by the propert value. For example, a property valued at $500,000 that rents for $450/wk has a rental yield of:-

Rental yield

=($450/wk x 52 weeks)/$500,000

= 4.68% (say 4.7%)

... but what does a rental yield calculation tell you?

While it might be useful for comparison purposes, calculating rental yield does not tell you much about the return on investment. Even if you pay cash for a property (thus eliminating the biggest expense for most investors, which is loan repayments), your return (cashflow) will be significantly less than the calculated rental yield.

A more important question to ask yourself before buying a property is, “Can I afford to hold it for the long term?”. The only way most people can answer this question is to undertake a cashflow analysis. Don’t fall for the sales agent’s headline that says, “Great investment at 6% return!” (meaning a rental yield of 6%).

Let’s say a property has a calculated rental yield of 4.7% per annum (p.a.) as in the above example (how to calculate rental yield). Repayments for the interest alone on 80% of the property value (assumes 20% deposit) plus up-front costs (say $20,000) at 5.5% (long term average) interest costs would be 4.6% of the purchase price per year. For a Principle and Interest loan (P&I), total repayments would be at 5.7% of property value (PV) p.a..

Note that if you get an Interest Only (IO) loan, most lenders require you to switch to a P&I loan after the first five years.

Loan Amount

= (80% x $500,000) + $20,000

= $420,000

Loan Repayments (IO)

= 5.5% x $420,000

= $23,100 p.a.

= 4.6% p.a. of PV

Loan Repayments (P&I)

= $2,385/month

= $28,620 p.a.

= 5.7% p.a. of PV

(RBAA loan repayment calculator used to calculate P&I repayments)

On top of loan repayments, there will be property manager fees, council rates, maintenance and repair costs, and insurance, which equates to another 2% (or therabouts) of the proerty value p.a.

Total holding costs and nett cashflow

Based on the above assumptions, the holding costs for our example property would be approximately $33,000 p.a. for an IO loan, or $38,500 for a P&I loan, which you would ultimately revert to.

To calculate affordability, deduct the total holding costs from the rental income (less an allowance for vacancies) to work out your nett cashflow. Typically, you would assume 90 to 95% occupancy rate in calculating rental income.

At 95% occupancy rate

rental income

= 95% x $450 x 52 wks

= $22,230

Therefore, nett cashflow is:-

$33,000 - $22,230 = -$7,770

for a IO loan

or

$38,500 - $22,230 = -$13,270

for a P&I loan

plus any tax benefits (depreciation + negative gearing), which could improve the bottom line by up to $5,000. This will vary, so be conservative in your assumptions or seek specialist advice.

Claiming depreciation as a tax deduction can help your cashflow and should be factored into a cashflow analysis. However it shouldn't directly impact on which property you buy. In fact older properties for which the building itself is not depreciable because of its age often stack up better in a cashflow analysis. In order to make the most of the poitential tax benefits of depreciation, consult with a quantity surveyor and tax accountant.

It is not unusual to discover a backlog of maintenance when buying an older property, so be prepared for this scenario. With due dillgence, this should be uncovered during the contract period. Just make sure (with your legal team) that the contract of sale provides you with options to manage this situation.

Unexpected expenses can hit a property investor at any time, such as replacement of a hot water system, blocked sewer, a tenant that leaves unexpectedly or stops paying rent, loss of full-time employment. Appropriate insurances and/or cash reserves should be held to manage through these contingencies.

A general rule of thumb for retention of cash reserves is about 6 months' income. A sudden increase in interest rates can rapidly eat into your reserves. Some investors opt for the certainty of fixed interest rates (at a premium) to hedge against this possibility.

Also consider income protection insurance, building and lanlord insurance. Get the cashflow calculations right up-front, and you have a good chance of avoiding the need to sell prematurely. You can download our free rental property cashflow calculator here.

Rental property cashflow analysis

Undertaking a thorough cashflow analysis prior to purchase is essential for success. A one-year cashflow analysis prior to purchase is helpful in determining an indicative annual cash position (before and after tax).

Here's what you need to do before you even start looking at property:-

do your own real estate cashflow analysis

work out your ongoing cashflow surplus or (most likely) deficit

make sure you have some head room for interest rate hikes

check that you have an adequate financial buffer (contingency fund) to deal with an unexpected set-back

Let’s take a closer look at the various elements of your real estate cashflow analysis, and associated risks.

Investment property maintenance costs

It just doesn’t make sense to intentionally let a significant investment (like a property) deteriorate over time. Why then, is investment property maintenance often neglected?

I wonder if it's because property owners are so stretched financially, and haven't adequately budgeted for maintenance costs.

"How much should I allow for maintenance?", you ask. That depends on a number of variables, such as:-

the age of the property

how well it's been maintained in the past

the type of construction

the type of landscaping

the climate conditions

the type of tenancy arrangement

Typically, an allowance of between 1 and 2 % of the property value per annum is advisable for budgeting purposes. This does not include the cost of improvements or significant renovations.

Strata title costs

Strata title property is basically a group of properties that share common areas, for example, a block of flats. The maintenance of the building (excluding the inside of the units), land and common areas is managed by a body corporate. The body corporate may include a professional property manager and all the owners of the individual units. Other costs, including management fees, common water and electricity charges, and building insurance are also managed through the body corporate.

Strata title fees (including building maintenance costs) tend to be lower than maintenance costs for freehold property at between 0.3 and 1.2% of property value. With freehold property you can defer maintenance expenditure without legal or financial penalty. For strata titled property, you can’t.

Analysis of Federal Court data has found 10 per cent of all forced bankruptcies across Australia are from strata levy debts (18% for NSW).

Source: Financial Counselling Australia. NB: this is adjusted for the Tasmanian registry which has had strata debts listed that originate in other states).

A well-managed strata title property will keep appropriate records of maintenance needs, planned maintenance, and maintenance costs. There will be annual maintenance fees paid by each of the property owners, and often a sinking fund from which prioritised, more significant maintenance costs are funded.

When times are tough, and even if you can keep up with the strata title fees, your fellow owners may not. When a body corporate isn't properly funded, the overall value of the property can be impacted. The value of your unit will also be impacted as a result. This risk can be considered when locating and selecting a property in the first place.

Be aware of low body corporate fees compared to fees charged on similar properties, as this can be an indication of a poorly maintained property.

Strata title risks

Buyers of strata title property need to be aware that there could be a backlog of unfunded maintenance needs. This can result in a need for owners to contribute a special levy for a specific (often costly) maintenance task such as the replacement of a roof, for example.

A review of body corporate records by a competent professional and (if required) a physical property inspection by a reputable building inspector is advisable during the contract period. This will help identify risks (financial, legal and maintenance risks) associated with a strata titled property.

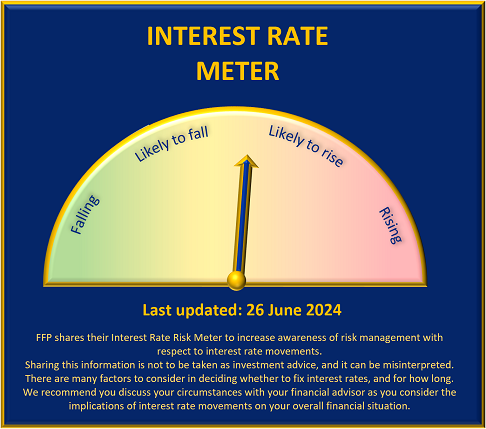

Interest rate risk

The risk associated with changing interest rates is closely tied to macro-economic risk. Because paying interest on loans is typically the largest of all property holding costs, it is extremely relevant to cashflow risk.

Therefore, property buyers of all kinds, and especially those that run with highly geared portfolios (not recommended), would do well to educate themselves about interest rate risks.

Find & Finance Property is seeking to increase awareness of interest rate risk and the drivers behind changing interest rates. We also discuss mitigating strategies that can use to manage these risks.

At the time of writing this article, many property owners are stretched with an interest bill that has doubled within twelve months. The sudden and sustained rise in interest rates from mid-2022 onwards was not surprising to those who monitor macro-economic conditions and interest rate cycles. Irrespective of the Reserve Bank Governor’s statement in March 2021 that interest rates would remain low until “at least 2024”, by Feb 2022, it became obvious that interest rates would not be kept under control.

Property owners had the opportunity to refinance and fix interest rates, but most didn't realise it until it was too late.

Finance structuring

Many lenders provide for a split between fixed and variable interest rates, so borrowers can have complete flexibility in how they structure their loans in accordance with their risk management strategy. An investment savvy mortgage broker or financial advisor can provide guidance on macro-economic influences and help you to structure your financial products in a way that’s consistent with your risk profile.

Click hereto find out more about proactive management of interest rate risks and macro-economic influences.

Property management fees

A good property manager is one of your key partners, so don't just think about getting one after you've signed a contract for sale. Do your homework up-front and find a reputable property manager that adds value and communicates well.

In particular, your property manager needs to be undertaking regular routine inspections, and on top of managing rent arrears. And above all, they need to have a robust and transparent tenant selection process.

Make sure your propery manager is aware that you want to be involved in the tenant selection process, and have the final say. Problematic tenants can be a significant set-back for your investment. Any property manager who has an issue with such a request is not worthy of the role.

If you need to change property managers, find your new manager first. Interview them to make sure they understand your expectations, and can demonstrate that they are operating at industry best practice. Once you've found your new property manager, you can give your old manager the prescribed notice (typically one month). Your new property manager should be able to handle the transition and/or advise you if they need assistance in your capacity as the client.

There is a lot of regulation associated with renting out your investment property, and you need a professional who is on top of all the legal requirements. Don't be tempted to do-it-yourself and save the 8-10% of the rental income that property managers take in commission. This is one area that you definitely need a professional on board, unless you are a qualified property manager yourself, and have the time.

Loss of income

What would happen if you lost your job and remained unemployed for 3-6 months? Are you adequately covered with relevant insurances and a financial buffer that will enable you to hold onto your investment property?

What if your or your partner had some sudden adverse medical news? Are you prepared for such a scenario? Consider your income protection, and health insurance needs in combination with any leave balances you may be due.

Make sure you have sufficient cash reserves to see you through a period of at least 6 months. Consider any additional costs that might be involved in medical treatment, for example, and check everything with your financial advisor.

Do whatever you can to hold onto your investment property for the longest practical term you can. You can lose money if forced into an early sale due to the relatively high initial costs, and short-term market fluctuations.

Conclusions

The data seems to indicate that not many property investors find it easy to hold onto their properties for the long term. While some instances can be put down to an intentional buy-renovate-sell, or similar strategy, the vast majority would appear to be due to cashflow difficulties and/or ignorance of the wonder of compound growth.

Doing enough up-front work to know that you are covered will help you sleep better at night, and realise the benefits of long-term capital growth in the property market. Being adequately prepared before-hand will help reduce the impact of the unexpected.

Become familiar with basic economic theory, and understand what drives property prices and interest rates. This will give you an advantage over most investors, and help you stay in the game for the long-term.

Obtaining quality professional advice and support when you need it can also ensure you have an adequate buffer for downside risk, and help you avoid buying a poor performing property.

When you are ready, you can undertake a first year cashlow analysis using our Basic cashflow calculator tool

Find & Finance Property

Find & Finance Property exists to support property buyers through education and provision of innovative tools and insights. It is our mission to equip property buyers to understand and manage their risk and invest with confidence.

NEWSLETTER

Manage your risk - invest with confidence