Find & FinanceProperty

Learn about property as an investment

What are the advantages and disadvantages of property as an investment?

How does property perform compared to shares or superannuation?

The answers might surprise you.

Find out what it takes to invest in real estate, and why propety owners are generally better off long-term.

With education you can achieve better than average returns on your property investment. Start learning today.

Key points

Property value is basically driven by inflation and population growth.

Property has historically performed better than shares and superannuation.

It takes time and financial discipline for most people to own property.

You can lose money if you are not adequately informed or educated.

Home ownership is typically the first real estate investment people make.

It takes about 15 years to break even on a home ownerhip vs renting comparison.

After breaking even, the financial benefits of home ownership are mind-blowing.

Property investment is not an easy option

Real estate investment is not an easy option. It’s ironic that some of the hurdles that keep people from investing in property are exactly what makes it a great investment. To buy a property, you need to: -

find money for a deposit and other purchase costs.

be prepared to hold the property for at least 10 years (longer really).

be prepared to put extra money in if needed to cover holding costs.

This can be a big stumbling block for investors, and there are easier alternatives available. However, we’d suggest that the same disciplines required for property investment are similarly required to successfully invest in other non-speculative asset classes. People often get caught out with alternative investments, like shares because they are too easy to buy and sell. Brokerage fees quickly add up, and market volatility can scare you into buying and selling at the wrong time.

These investments don’t force a disciplined, patient approach like property does.

The old term “safe as houses” gives the impression that property investment is a safe proposition. However, you probably know of someone who has experienced a failed property investment. While no-one can guarantee success, there is a lot you can do to minimise the risk of a failed property investment and maximise the upside potential. Our purpose here at Find & Finance Property is the help property buyers of all kinds to do just that.

Over the long term (20+ years), property can be a great investment (possibly the best of all investment options); but it all comes down to understanding and managing both risk and potential.

Click here for more information on managing risks associated with buying property.

Advantages of property as an investment

Following are some advantages of real estate over other asset classes.

It has proven long term capital growth (avg about 6% p.a. compound growth)

If held for the long term, it becomes cashflow positive.

Increasing demand for preferred locations with increasing population growth

It can be improved over time, increasing asset value.

It can be highly leveraged.

It provides a hedge against inflation (the best one?).

Owner-occupiers can insulate themselves from rising rents and manage the risk of rising interest rates through timely fixing of interest rates.

It can form the basis for a diversified investment portfolio.

a wide variety of investment opportunities are available.

when taking a borderless approach, with good data analytics, opportunities for early capital growth are generally available somewhere in the country.

Property vs other asset classes

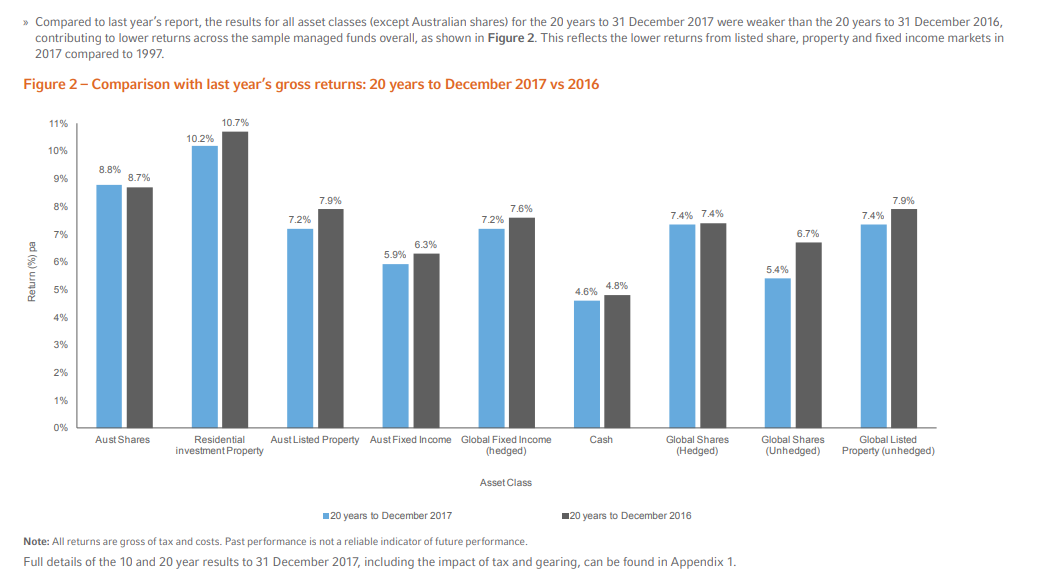

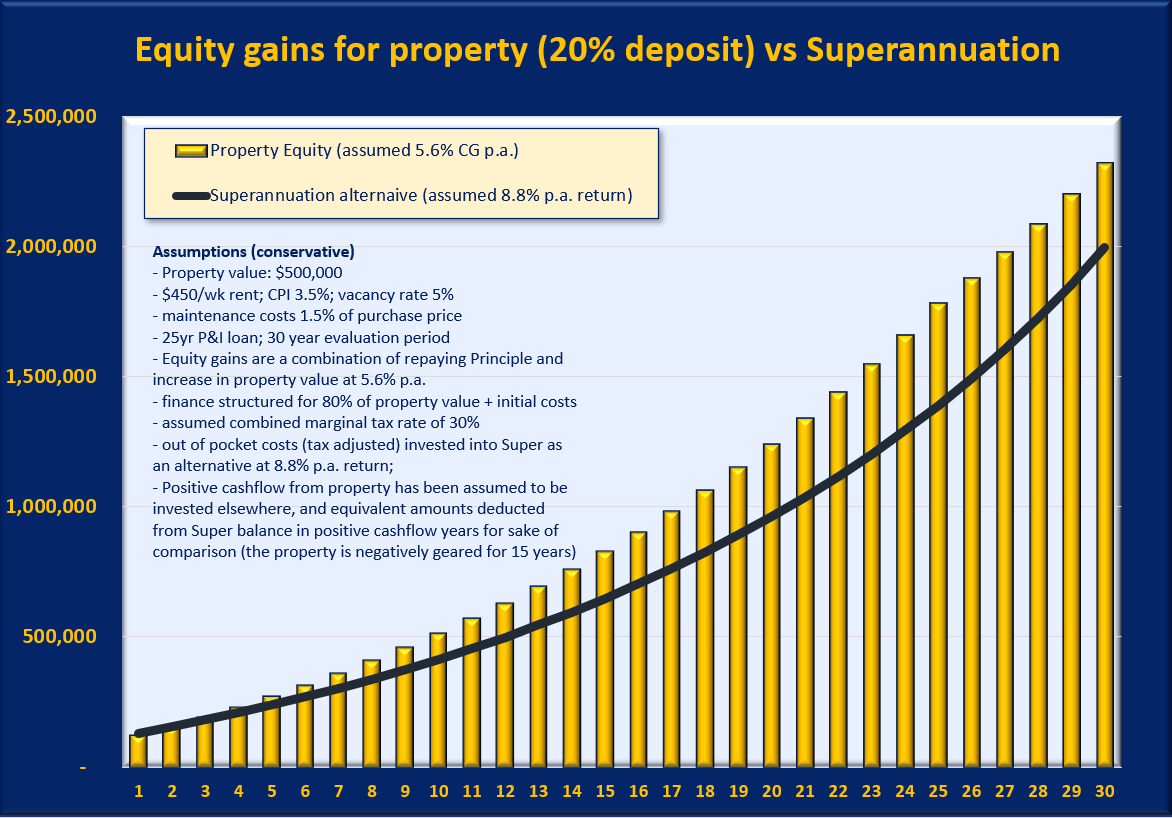

The Russell Investments/ASX Long-term investing report is typically used by investors to rank the best performing asset class for the last 10 to 20 years. Property was the winner over both periods when all input costs and benefits are considered.

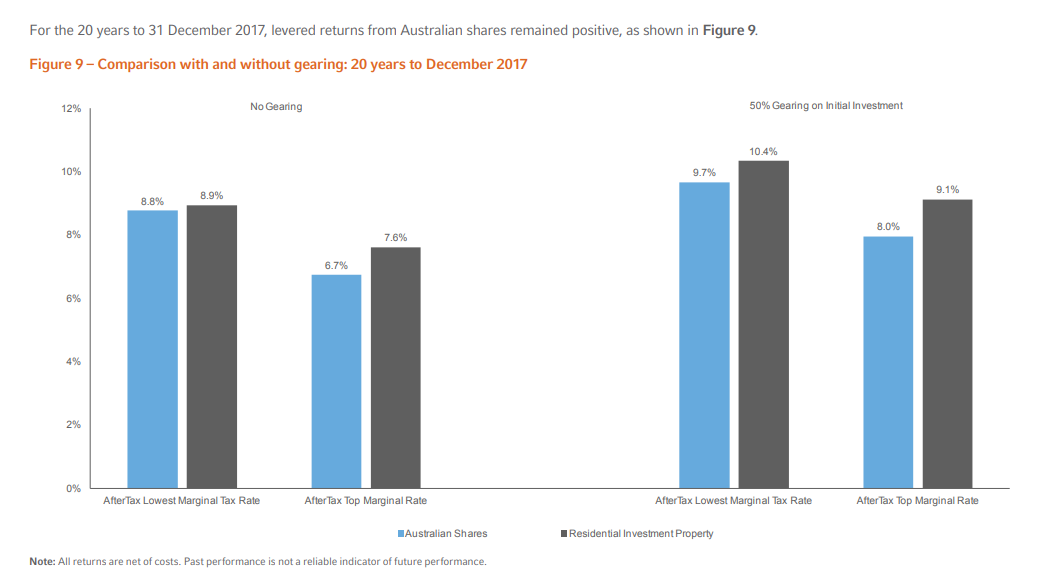

The following chart shows that property performed better than shares (the next highest performer) by between 7% to 13.8% over 20 years, depending on the tax bracket. This is based on the assumption that both were geared with 50% borrowed on the initial investment.

Average gearing ratios for property in Australia are currently around 60%. Gearing levels for shares on the other hand would be considerably lower say about 30%) with maximum gearing ratios of only 50-65% available vs 80-95% for property.

A fairer comparison would see shares geared at 30% vs property geared at 60%. Based on projections from the chart, this would result in 9.2%(shares) vs 10.4%(property) for lowest tax rate; and 7.5%(shares) vs 9.1%(property) for the highest tax rate. This revision sees property out-performing shares by 16.8% over 20 years, assuming a straight-line average between the extremities of the tax bracket.

Past performance is not a reliable indicator of future performance. And we’re not seeking to discourage investment in shares. What we are pointing out here is that real estate should not be considered an inferior investment class to shares.

People who are willing to put in time and effort to educate themselves on managing risk and maximising opportunity can do considerably better than average as a property investor. They can also invest in shares and other asset classes with the equity gained in their property.

Advantages of home ownership

Owning your own home (or having a mortgage on it) is helpful financially. It also comes with non-financial benefits: -

Stability and security: Owning a home provides stability and security for individuals and families, as they do not have to worry about sudden rent increases, landlords selling the property, or otherwise not renewing a rental lease agreement.

Control over property: Home owners have the freedom to make modifications and improvements to their property as they see fit, without needing permission from a landlord.

Greater sense of community: Home ownership can lead to a stronger connection to the local community, as home owners typically stay longer. They generally have more of a vested interest in the well-being of their neighbourhood.

Financial advantages include: -

Appreciation in property value, assuming a continuation of long-term historical trends.

Potential rental income: Home owners have the option to rent out a room for additional income, providing a potential source of passive income.

Forced savings: Home ownership can serve as a form of forced savings, as home owners build equity in their property over time.

There is a lack of objective published data on this subject and a lack of unanimous support for home ownership among financial advisors.

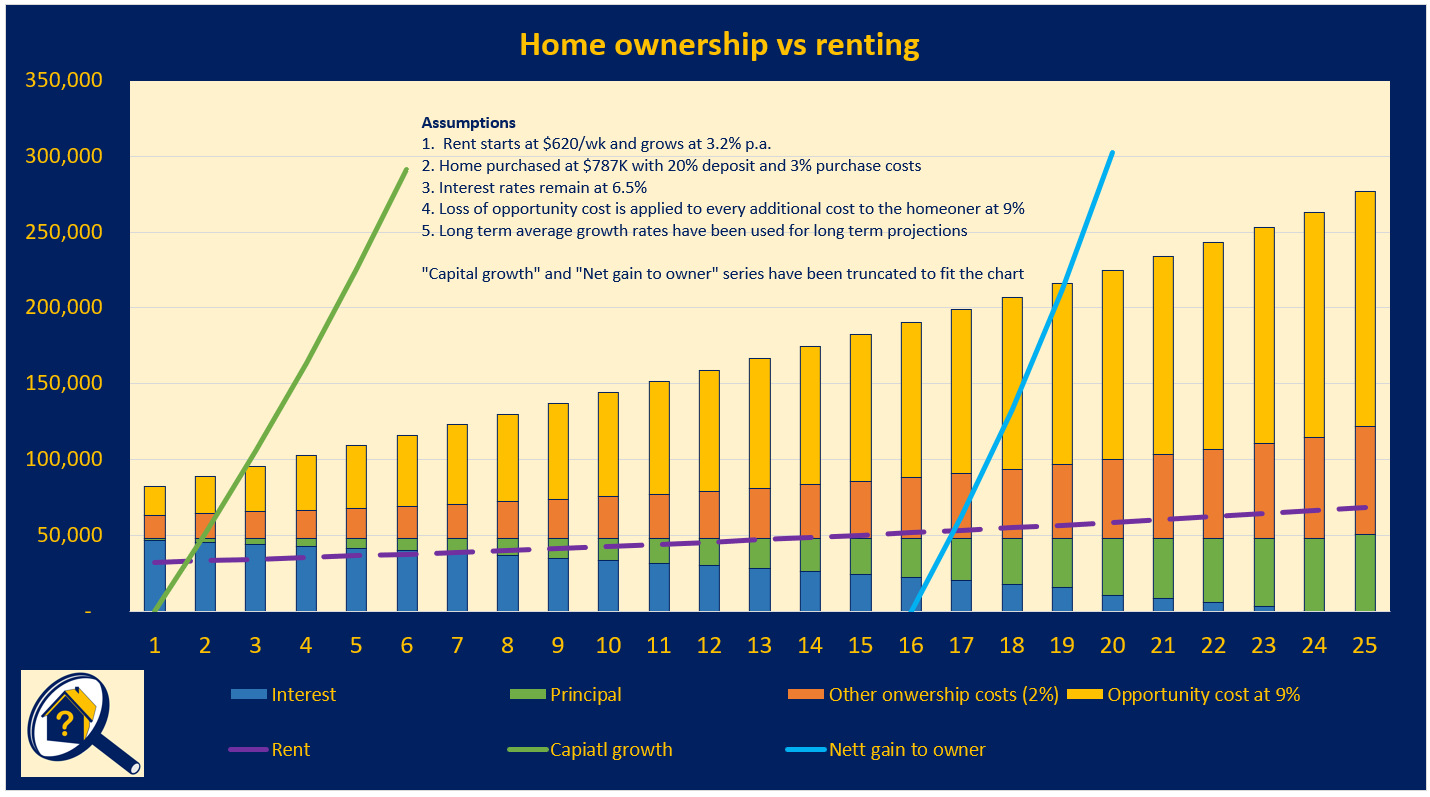

We undertook our own comprehensive analysis using the average rate of rent at the time of writing ($620/week) versus the median house price ($787,000), which uncovered the following.

Total net gains to property owners begin from the first year, assuming a consistent rate of capital growth for the home (at 6.5% p.a.)

The net gain is masked by higher loan repayment and property ownership costs (3% p.a. assumed)

In the seventh year, interest repayments (assumed steady at 6.5% p.a.) will become lower than rent (assumed to grow at 3.2% long term average)

In the fourteenth year, total loan repayments (steady at $3,979.50/month) will be less than rent.

Home ownership costs may always be higher than rent (initially about twice the cost but reducing over time) when all property ownership costs considered (including maintenance and opportunity cost)

Assuming a generous opportunity cost of 9% p.a. on a 20% deposit plus added home ownership costs over 25 years, the home owner breaks even at 16 years.

Thereafter, the return on investment to the home owner escalate every year to be 33% ($907K) more than the renter assuming the same total outlays over 25 years ($1,718M) invested at a 9% p.a. return.

If opportunity cost is not included in the analysis and other ownership costs are reduced to 1.5%, the home owner breaks even at 14 years and is $1.16M ahead of the renter at the 25-year mark.

Home owners need to be more disciplined financial managers due to the higher costs of home ownership, including maintenance, rates, insurance, paying back principal, and so on. It is unlikely that the alternative of renting would result in all potential savings being invested into profitable investments. Therefore, this analysis is conservative, but clearly demonstrates the advantage of home ownership.

Home ownership is the classic vehicle to demonstrate the benefits of disciplined financial management and compound growth. It takes considerable determination and financial discipline to accumulate the recommended 20% deposit. Financial discipline and compound growth work together to make home ownership a form of superannuation, and this is why home ownership is financially superior to renting. It’s a long-term strategy. Home owners accept short to medium term pain for long term gain.

The great Australian dream of owning your own home is a great way for beginners to start their property investment journey. It teaches financial discipline, which is perhaps the most important skill for property investors to learn.

There are two scenarios where financial benefits are not realised by home owners. One is when they are forced to sell early (within 15 years, dependent on market conditions). The other is when they buy a property that underperforms in relation to capital growth. The risk of both these scenarios should be considered and a management plan developed before committing to home ownership.

Investing beyond the family home

All the knowledge and discipline involved in buying and holding your own home applies to buying an investment property. Providing you are ready both financially and educationally, going on to buy an investment property can be even more rewarding.

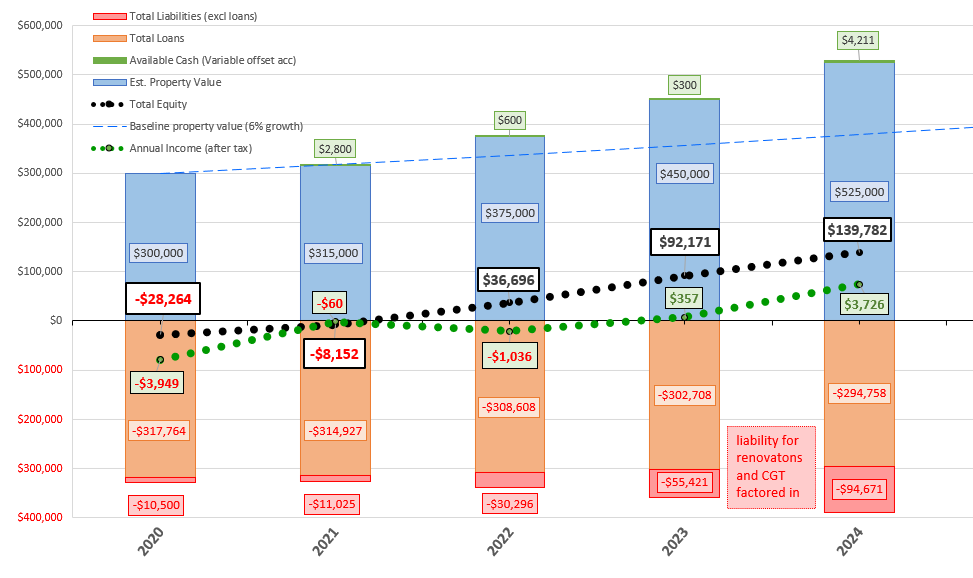

The biggest advantage that investors have is tenants to contribute to the holding costs, and ultimately make the property cashflow positive. Then you have an investment that has both capital growth potential and generates income. The following chart is an example of an investment property advancing from negative to positive cashflow.

The total equity in this example has been moderated to allow for significant renovations and factors in Capital Gains Tax liability due to capital growth. The chart also shows that better than benchmark capital growth can be achieved (especially in the important early years) through effective market research and data analysis. The property in the chart also has an added low-cost/high-value improvement option. Thorough market research will help find suitable locations, property types and timing to buy an investment property.

Having a cashflow positive property will help you to hold real estate for the long term and grow a property portfolio over time. It’s important to note, however that less than 30% of property investors progress beyond one investment property. There are several reasons for this including: -

Diversification of investments and personal preferences

Financial constraints (typically due to insufficient cashflow or lack of a convincing plan to satisfy lenders)

Not comfortable taking on more risk, often having not had early success with their first investment property.

Lack of understanding of how to restructure finance.

Lack of knowledge of how to manage risks and develop a winning strategy.

Given the potential that real estate investing has for superior returns (especially for the educated) it’s our hope that you take the time to develop an effective strategy before you embark on the journey. Our mission is to help you succeed by providing you with valuable insights at no cost, and/or help you find appropriate support.

What drives property value?

Broadly speaking, property prices are fuelled by inflation and population growth. Because property is a real asset, its value grows over time compared to a currency that tends to devalue over time due to inflation. You can read more about inflation and how it influences interest rates here. Australia is a relatively young country. Our population has nearly doubled over the past 40 years. Increasing population creates demand for more property.

When considering supply and demand pressures at the local level, many factors can influence property value. The following list provides just a sample: -

The land value component, or the land-to-asset ratio of a property.

Scarcity of a particular type of property

Locations and property types that appeal to owner-occupiers

Government investment in infrastructure such as roads, schools and hospitals.

Private sector investment in infrastructure such as airports, resorts and shopping centres.

Industry including mining, manufacturing, tourism and service industries.

Increases in property value are ultimately tempered by affordability. The price point that balances supply and demand for property of a given type in a given location will be set by what buyers can afford to pay.

Studying the demographics can provide insights into the growth potential of property in specific locations. Key factors to consider include population growth rate, average income and average household size.

Rentvesting

Rentvesting is a strategy that has been used effectively by some property investors. It involves buying one or more rental properties while continuing to live in rented accommodation.

This strategy might be attractive to people whose lifestyle and/or location requirements don’t support buying a property to live in. It also suits people who prefer not to be tied to a residence long-term and have spare cash to invest in real estate. It’s not suitable for those who are concerned about the potential of being forced to move from property to property or pay higher rent to stay.

One way rentvestors (and property investors more generally) make the finances work is to skimp on property maintenance. Timely property maintenance attracts better tenants and rental yield. Sometimes a lack of regular maintenance can cause holding costs to snowball.

Most rental properties don’t provide positive cashflow from day one. This means that as well as paying rent, you will most likely need to contribute ongoing funds to your investment property. Typically, it will be 5-10 years before an investment property (residential) becomes cashflow positive. You can estimate your first year cashflow using our basic cashflow calculator. However, a more comprehensive financial analysis of costs and benefits of rentvesting should be undertaken before adopting this strategy.

For more on rentvesting, refer to this article by Property Investment Professionals of Australia

Before rentvesting, carefully consider the advantages and disadvantages compared to home ownership. Every situation is different, but for most people, home ownership is preferred. This is especially true for those living in regional cities where property is generally more affordable and lifestyle more stable.

Downsides to property investment

high up-front costs.

the risk of paying too much and/or buyig a lemon.

it requires time and a financial discipline to get started.

exposure to rising interest rates.

potentially servicing an elevated level of debt for a long period

inherent risk of property ownership including cashflow and market risk.

not being well informed of these risks and receiving bad or sub-optimal advice.

Conclusion

Investing in real estate can be risky. However, for those who understand and manage the risks, it can be extremely rewarding. Potential benefits include an early and/or more comfortable retirement, and less financial stress after the initial accumulation period.

Home ownership is an obvious first step for many property investors. This helps develop the discipline and culture of paying down debt, which is exceedingly difficult to replicate as a renter. Achieving leveraged returns on a mortgaged property is a financial reward that is enjoyed by home owners who are committed for the long-term.

On average, home owners are much better off later in life than renters, even if they never buy another property. Informed property investors take it to the next level. They effectively super-charge their savings with a vehicle that’s comparable to superannuation, but which offers them more flexibility.

No investment strategy is fool-proof, and there will always be events and circumstances we can’t control. However, putting in the hard work up-front to manage what we can control is the best way to minimise the chance of failure and maximise the potential benefits.

NEWSLETTER

Manage your risk - invest with confidence